# NibiruBFT: Block Lanes

NibiruBFT introduces block lanes to solve blockchain congestion, MEV, and scaling issues. Learn how multi-lane mempools and dedicated MEV lanes improve transaction efficiency and fairness.

# TL;DR / Takeaways

- Multi-Lane mempools segregate transactions by priority, ensuring critical transactions bypass congestion

- Improved network performance reduces wasted block space and ensures timely execution of essential transactions

- Efficient gas markets prevent MEV-driven gas wars and optimize transaction costs.

- Dedicated MEV lanes contain extractive behaviors, ensuring fair and predictable execution

- Backward compatibility allows seamless adoption without disrupting existing applications

# 1 - The Legacy Mempool Model: Where We Started

The blockchain ecosystem has expanded significantly since Bitcoin introduced Proof-of-Work, yet it still struggles to meet the increasingly complex demands of today’s web3 environment.

# 1.1 - First-Price Auctions: When Overbidding Ruled

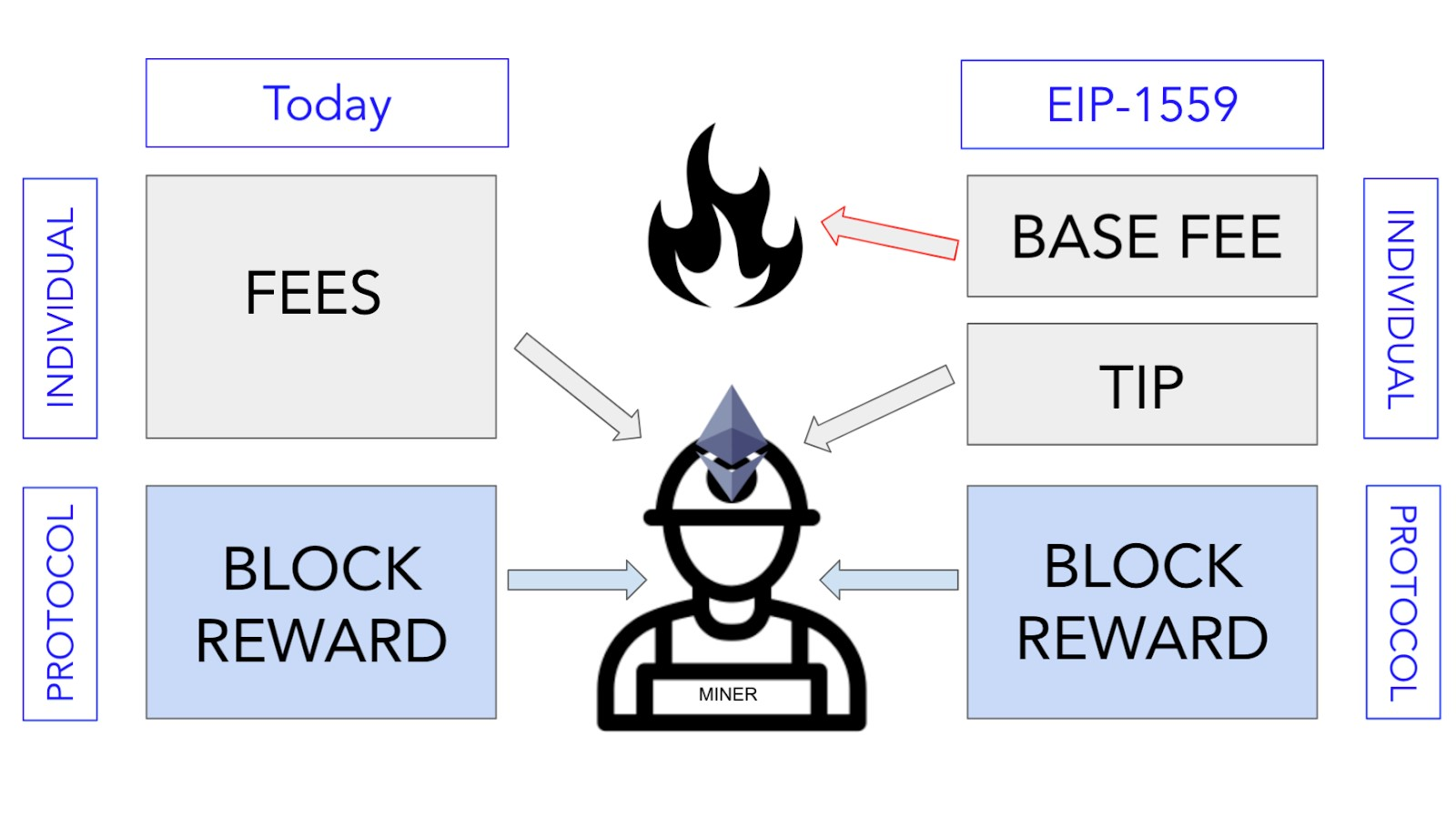

Traditional mempool structures treat all transactions equally or rely solely on primitive gas markets (such as in EIP-1559) for prioritization. Prior to EIP-1559, Ethereum used a first-price auction model (opens new window) whereby users bid for transaction inclusion by specifying their gas fee. This model led to inefficiencies, as the ability for a user’s transaction to be included in the block depended solely on the relative value of their specified gas fee versus their peers. This caused users to unnecessarily overbid for inclusion.

# 1.2 - EIP-1559 Gas Markets: A Meaningful Yet Partial Fix

EIP-1559 attempted to address these inefficiencies by dissecting gas into two parts: a base fee and an optional priority fee. The base fee, dynamically calculated based on network demand, added some predictability and reduced complexity and guesswork in determining transaction fees. Previously, users would overpay or experience delays due to underpayment.

Nowadays, many blockchains have adopted a similar base + priority fee structure. While this is an improvement over pre-EIP-1559 gas markets, the gas market structure remains too simplistic. It fails to account for time-sensitive transactions that may require prioritized execution and for different transaction types with varying resource requirements.

# 1.3 EIP-1559 and Its Single-Lane Blocks Constraints

In an auction where every bidder must pay a fee to participate, even though only the highest bidder wins the prize. This means that even if most bidders lose, their bids still need to be processed and clog the system—much like how losing transactions in Ethereum’s gas auction consume block space and compute despite failing.

Similarly, single-lane approaches often result in wasteful inefficiencies. When certain transaction types dominate, block space may be underutilized. In the primitive gas auction model, transactions that bid the most gas are most likely to be included by miners, who directly profit from a portion of the gas bid. The nature of gas markets in Ethereum is structured around the partial all-pay auction model, where only the top bidder “wins,” and other bidders still pay partial gas fees despite their transaction reverting (a penalty on “loss”). Similarly, despite these “losing” bids failing and reverting on-chain, they still consume and waste block space. Despite this being an intentional design choice to mitigate network DDoS, reverted transactions still unnecessarily consume computation costs and block space.

# 2 - How Network Congestion Drives Up Gas Costs

Gas pricing is also inflated during times of network congestion, which stifles crucial transactions unless sufficiently high gas fees are paid.

# 2.1 - A High-Stakes Example: Gas Wars vs. Critical Operations

Consider the example of a perpetual futures platform on Ethereum. Recent memecoin mania has caused extreme network congestion, where the mempool is dominated by DEX swaps. Imagine a liquidator attempting to liquidate an underwater position on this platform. Due to the network congestion caused by memecoin activity, gas fees are exorbitantly high.

The liquidator’s model suggests the liquidation is profitable, but:

- The liquidator must compete in gas markets, bidding a higher gas fee, which cuts into their profits and may make the liquidation unprofitable (negative EV).

- The liquidator must sign the transaction and hope that by the time it is executed, the collateral has not moved further against the position.

# 2.2 - Congestion’s Ripple Effects: Liquidations, Protocols, and User Experience

Both outcomes are suboptimal for the liquidator, the trader, the LPs, and the protocol’s insurance fund. Liquidations must be executed in a timely manner to ensure effective risk assessments and sufficient liquidity of assets. Network congestion muddles EV calculations, reduces profits, and can render certain liquidations unprofitable, leading to unnecessary bad debt and potential insolvency.

These limitations negatively affect user experience. As a result of single-lane mempool and block designs, users experience unpredictable transaction confirmation times, gas price volatility and bidding wars, inconsistent transaction ordering, and difficulty executing time-sensitive operations.

# 3 - The Multi-Lane Solution: Creating Dedicated Transaction Pathways

Block and mempool lanes represent a sophisticated approach to addressing these challenges by introducing priority processing paths for different transaction types.

# 3.1 - Understanding Gas PvP: The Real Cost of Competition

The Floating Balls Analogy: Understanding Mempool Priority Imagine the mempool as a bucket of water, with each pending transaction represented by a plastic ball. In a simple mempool design, a validator just scoops up a ball at random for block inclusion. Introducing priority fees is like making certain balls out of a lighter material, causing them to float higher and get picked first. But if everyone can pay extra to use the lighter material, it becomes a free-for-all where only the highest payers float to the top. Without any differentiation for transaction types, even urgent or critical transactions must battle all others in this pay-to-win scenario.

# 3.2 - Multi-Lane Mempools: Curbing PvP on a Network-Wide Scale

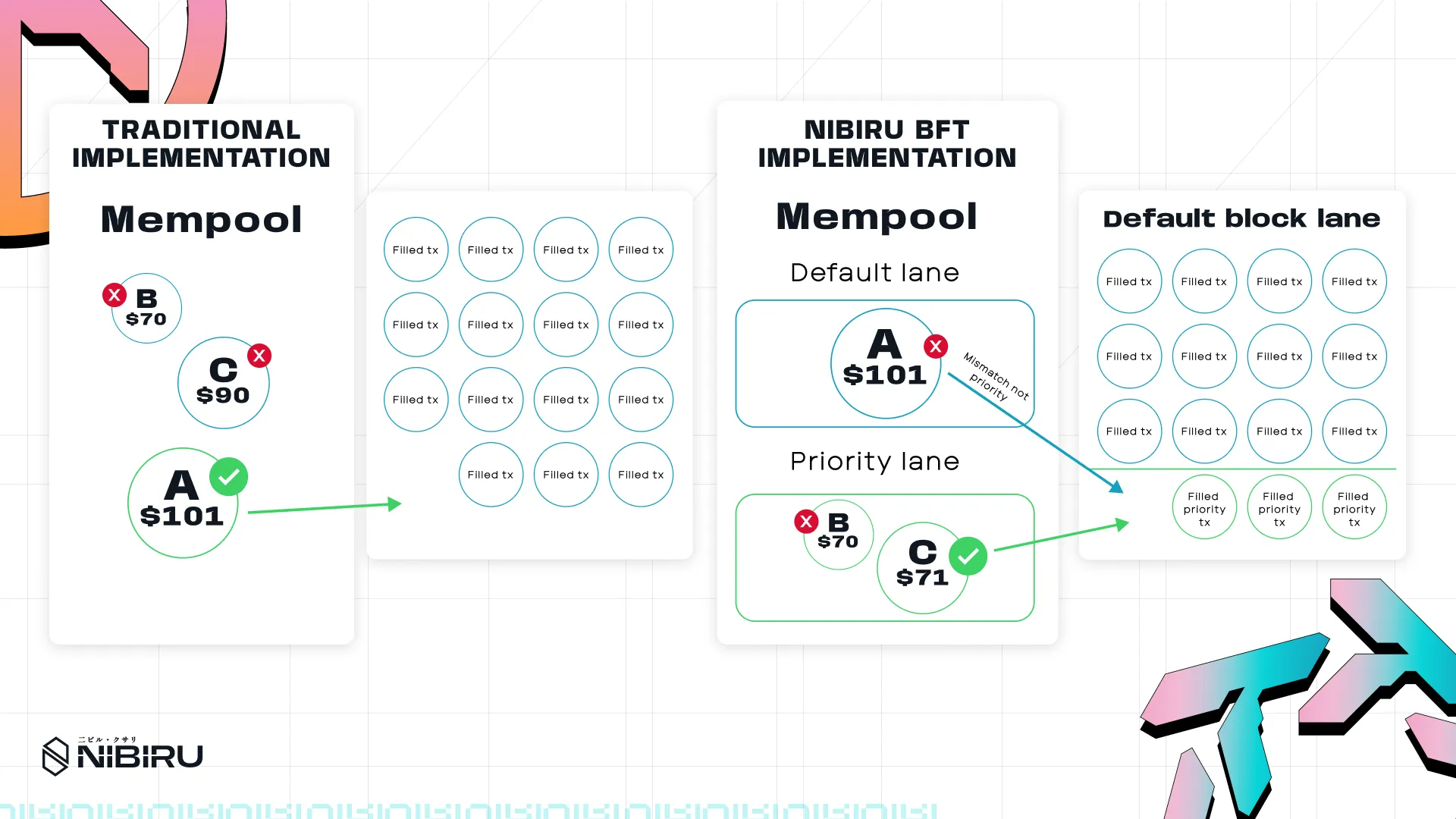

Mempool/block lanes introduce segregation for critical transactions. Instead of one bucket, there are two: one for base priority transactions and another for higher priority transactions. Validators are required to select a certain number of transactions per block from the higher priority bucket. PvP competition still exists but is limited to transactions within the same priority bucket. Base priority transactions cannot displace higher priority ones, ensuring crucial transactions are included even during congestion.

The core concepts behind such an implementation are fairly simple.

# 3.1 - Lane Segregation: Smarter Queues and Dynamic Resource Allocation

The first step is lane segregation, where transactions are categorized into different lanes based on metadata flags. Each lane maintains its own priority queue and resource allocation, allowing for separate gas markets. Block space is pre-allocated across lanes to ensure balanced processing.

Having separate lanes also enables dynamic resource allocation. If one lane isn’t fully utilized during certain network conditions, its unused capacity can be shifted to other lanes.

One interesting point of discussion within the Nibiru research team is to capitalize on recent AI developments and the potential to integrate AI into Nibiru's long term V2 roadmap. One possibility here is to utilize AI to be able to predict when priority lanes may become congested and adjusting lane allocations ahead of time. Our team (notably our CEO, Unique) have backgrounds in AI to facilitate such an undertaking.

Lanes are generally split into a fast lane and a standard lane, with the option for further subdivisions if needed. High-priority, time-sensitive transactions (like liquidations or oracle updates) are whitelisted for the fast lane, while routine transactions such as token transfers, NFT mints, and general contract calls go through the standard lane.

Example: How Lane-Based Mempools Shield Liquidators from Costly Bidding Wars Imagine Alice, a memecoin trader, and two liquidators, Bob and Charlie, all vying for the last slot in a block. Under a basic mempool design, Alice can offer an exorbitantly high gas fee, forcing Bob and Charlie to outbid her—potentially making their liquidations unprofitable. However, in a lane-based model, Bob and Charlie only compete with each other in the high-priority lane, ensuring one of their transactions gets included without needing to surpass Alice’s excessive bid. In a lane-based block and mempool model, if the high-priority lane still has capacity, Bob and Charlie only compete against each other. Without needing to outbid Alice, they avoid excessive fees and prevent bad debt, helping maintain the protocol’s solvency.

# 3.2 - Transaction Payloads and Execution Flows: Adding Lane Identifiers

Lane-based mempool and block designs require modifications to both transaction data and the execution process. Each transaction now includes a lane identifier—either through protobuf flags (for Wasm) or markers in the transaction payload (for EVM). Here, it would be up to the validator to decode the protobuf to determine the transaction type. This does not require consensus - mempools and their contents are defined locally. If no lane identifier is provided, the transaction defaults to the standard lane, maintaining backward compatibility.

On the execution side, each lane enforces its own gas rules. Block producers validate transactions by checking that total lane usage does not exceed the allocated quota. Fast lanes might demand higher base fees or require that a transaction be whitelisted (e.g., for liquidations), while standard lanes allow typical throughput. This approach segregates fees, priorities, and resources across lanes, enabling time-critical transactions to execute efficiently without competing against less-urgent activity.

# 3.3 - Ordering and Compatibility: Respecting Lanes Without Breaking Legacy Apps

Once lanes are established, the block builder must respect each lane’s priority and allocation when ordering transactions. For example, Skip’s Block SDK’s lane configuration (opens new window) allows developers to list lanes in a specific order—fast lane first and standard lane last—so the most time-sensitive transactions automatically receive earlier inclusion. This ensures fast-lane transactions aren’t displaced by higher-paying but less-urgent operations.

At the same time, backward compatibility is critical. Legacy transactions without lane metadata (e.g., older dApps that haven’t upgraded) should seamlessly fall back to the default or standard lane. This “graceful fallback” approach maintains consistent behavior for existing contracts and user flows. It also means both lane-aware and legacy transactions share the same gas market logic—if an untagged transaction simply enters the base-priority lane with no special privileges, network participants can continue using older tooling without interruption. By avoiding a hard cutover, chains can phase in lane-based upgrades at their own pace, reducing disruption and fostering a smooth transition.

# 4 - MEV Lanes: Containing Maximal Extractable Value

Building on the recognized need for lane segregation in blockchain architectures, we analyze how Block SDK’s MEV lanes could impact MEV extraction in the context of priority gas auctions (PGA). While lanes serve as infrastructure for transaction segregation, it is crucial to understand how MEV functions within these lanes, especially when designing an architecture specifically aimed at MEV management.

# 4.1 - MEV 101: Why It Matters to Everyone

First, let's explore what MEV is and why an MEV lane is necessary. Initially termed Miner Extractable Value, MEV described the maximum value a miner could extract by controlling block ordering. Over time, the definition evolved into Maximal Extractable Value, reflecting a broader scope beyond miners. By leveraging the public mempool and priority gas auction (PGA) mechanics, not only miners but also independent actors—commonly known as searchers—can extract value from the way transactions are organized within a block.

MEV encompasses not only the ability to extract value by rearranging transactions within a block but also the power to include or exclude specific transactions. These opportunities include:

- Arbitrage: Profiting from price discrepancies between decentralized exchanges.

- Liquidations: Seizing undercollateralized positions on lending protocols.

- Frontrunning, Backrunning, and Sandwich Attacks: Manipulating pending transactions to gain an advantage, often at the expense of regular users.

The presence of MEV introduces unique challenges, including network congestion, transaction reordering, and resource competition.

- Network Congestion & Resource Competition: Searchers engage in bidding wars, continuously raising priority fees to secure transaction inclusion. This bidding and counterbidding process inflates gas fees. Even failed bids can still be included in a block but ultimately revert on-chain, needlessly consuming block space and computational resources.

- Transaction Reordering: Since priority gas auctions (PGA) incentivize block builders to prioritize transactions with the highest fees, MEV-related transactions can outcompete essential network processes, such as oracle updates and liquidations, potentially leading to inefficiencies and market distortions.

# 4.2 - Carving Out an MEV Lane: Keeping Searchers in Check

The need for MEV lanes arises from these challenges. By isolating MEV-related transactions into dedicated lanes, networks can contain extractive behaviors within specific sections of a block while ensuring that high-priority, critical operations have their own reserved block space.

Additionally, segregating MEV activity allows for the creation of distinct gas markets, preventing MEV-driven counterbidding from artificially inflating gas prices for regular transactions. This also introduces predictable transaction ordering for both searchers and general users, improving network efficiency and fairness.

Building on the necessity of lane segregation in blockchain architecture, let’s examine how Block SDK’s MEV lanes could help manage MEV extraction in the context of priority gas auctions (PGA).

# 4.3 - Block SDK MEV Lanes: Key Assumptions and Benefits

The Block SDK implementation recognizes that MEV extraction cannot be eliminated—this is inherently true when operating with a public mempool, where searchers continuously scan for MEV opportunities. Instead, Block SDK’s MEV lanes serve as a mechanism to contain these potentially extractive behaviors within designated lanes.

This approach acknowledges MEV as an unavoidable aspect of blockchain operation and focuses on managing it effectively. By doing so, it ensures the integrity of core primitives, such as oracles, while also protecting high-liquidity and latency-sensitive transactions from disruption.

# 4.4 - Top-of-Block Placement: Securing MEV Bundles

MEV transactions are inherently latency-sensitive. Block SDK’s MEV lane provides a dedicated space for MEV-specific transactions, ensuring top-of-block placement and atomic execution of ordered transaction bundles.

By reserving the top of the block for MEV transactions, searchers no longer need to compete in a block-wide race for the first transaction slot. Instead, they compete only within the allocated MEV space at the top of the block. In effect, a separate priority gas auction (PGA) is enforced specifically for MEV transactions.

This implementation can be observed in lanes/mev/mempool.go:

This priority system illustrates how MEV extraction can be confined to a dedicated lane. While transactions still compete based on bid amounts, the competition remains within the lane’s allocated block space, preventing MEV-driven bidding wars from dominating the entire block.

# 4.5 - Safeguarding Critical Transactions: Preserving Essential Blockspace

As discussed earlier, this implementation enables sophisticated transaction

management, ensuring that critical operations such as liquidations and oracle

updates retain their allocated block space. This functionality is evident in

ProcessLaneHandler() within lanes/mev/abci.go:

Notably, the lane handler processes the first transaction in the proposal. If the

first transaction (bidTX) is not an MEV transaction, the system enforces that

no MEV transactions appear later in the block. This is necessary to uphold the

rule that MEV transactions must be confined to the top of the block. This

approach ensures two key outcomes:

- MEV transactions are always executed at the top of the block. Oracle updates and liquidations should be classified as MEV transactions, and further segregation of the MEV lane should enforce that oracle updates/liquidations are executed at the top of the MEV block.

- MEV transactions do not interfere with regular transactions further down in the block.

Additionally, protocol-level resource controls are implemented in

VerifyBidBasic() within lanes/mev/abci.go:

These hard limits - again, enforced at the protocol level- prevent resource exploitation and egregious PvP. By implementing these constraints, it provides stronger guarantees on network resource usage compared to market-driven, economic incentive approaches.

# 4.6 - Why Block SDK

At Nibiru, we have also closely examined alternative approaches to managing MEV, including private auction systems like Flashbots. Now, let’s explore why, for our specific purposes, implementing Block SDK’s MEV lanes may serve as a more effective initial approach compared to Flashbots.

The primary consideration is user experience. For newer chains where complex MEV patterns have not yet developed, Block SDK’s lane implementation offers a significantly simpler approach. This simplicity is valuable, as integrating validators into the Flashbots architecture can be challenging, requiring a deep understanding of searchers, relayers, and related components.

Additionally, private auction systems tend to disproportionately benefit advanced validators capable of executing complex modeling to optimize bids, raising concerns about centralization. In this sense, the key advantage of Flashbots—its private auction structure—is also a drawback, as it reduces transparency and predictability in transaction ordering.

Secondly, laned systems fundamentally reshape execution economics by establishing separate gas markets for each lane. This segmentation creates isolated economic incentives, allowing for more refined and controlled gas dynamics compared to block-wide PGA systems.

Block SDK’s MEV lanes offer a structured yet practical approach to managing MEV, which is inherently unavoidable. For newer chains like Nibiru, the protocol-level guarantees, streamlined infrastructure, and predictable resource management present clear advantages over more complex MEV extraction frameworks.

While advanced solutions like Flashbots may become more relevant as Nibiru matures and MEV behaviors grow more sophisticated, Block SDK’s lane implementation currently provides a strong foundation for effectively managing transaction priorities.

To bridge the gap between our choice of Block SDK’s MEV lanes and the practical steps for implementation, we now turn to the design of a structured rollout. Ensuring a smooth transition requires careful consideration of network stability, validator participation, and the phased introduction of lane-based execution. This next section outlines the planned approach for integrating MEV lanes while maintaining compatibility with existing validator infrastructure.

# 5 - Designing a Lane-Based Rollout

# 5.1 - Rebooting the Network with Lane Defaults

The planned approach is to undergo a total network upgrade where, by default, all transactions are assigned to the base priority lane and transactions will undergo a gradual whitelisting process. As mempools vary locally and blocks are proposed with the sole discretion of the block proposer, not all validators must upgrade to the latest lane-supported software to participate in consensus. Validators who upgrade can utilize the application logic to assign priorities to lanes, but validators still on legacy software would have non-segregated mempools and also would propose legacy blocks without laning.

# 6 - Practical Integration with the Skip Block SDK

The team at Skip Protocol are at the forefront of such laned innovations. Their

Block SDK provides tooling to implement both mempool and block lanes. To do so

appears fairly simple looking at Block SDK documentation. Below specifies the

structure for initializing a new lane in app/app.go as per Block SDK

specifications (opens new window):

We see that Block SDK allows us to specify what percentage of the block space

should be occupied by transactions of the specific lane, as well as the maximum

number of transactions. In the code above, x% (maximum a) of the block should

be occupied by fast-laned transactions, while y% (maximum b) of the block

should be occupied by default laned transactions.

Lane priorities should then be specified by the ordering as shown below:

We must then implement new lane antehandlers and proposal handlers, but for brevity, these implementations will not be discussed.

Finally, in app/mempool we must implement the logic for each lane (e.g. for

fastLane we must implement app/mempool/fast_lane.go). Here, we would examine

transaction metadata to determine if a transaction qualifies for fast lane access

(e.g. is it a liquidation? Is it an oracle update? Is it a high priority contract?,

etc.).

# 7 - Final Thoughts: Security, Future Research, and Best Practices

Although implementing the Block SDK may seem straightforward, the introduction of block and mempool lanes brings new security considerations. Priority lanes create potential avenues for economic exploits and malicious strategies, including cross-lane MEV extraction by exploiting gas price differentials—leading to sandwich attacks. Attackers might also misuse priority lanes by inserting deceptive transaction metadata to push lower-priority transactions into higher-priority lanes, or orchestrate lane-flooding attacks.

Implementing block and mempool lanes achieves more granular control over block building and transaction processing. However, several key factors still require research and refinement. These include dynamic lane allocation based on network conditions and economic modeling for optimal lane pricing. Additionally, cross-lane behavior optimizations must be explored, along with scalability concerns such as state growth, network bandwidth, and node hardware requirements. The success of lane-based approaches will hinge on addressing these concerns while maintaining backward compatibility, and on delivering improvements in both processing efficiency and user experience.