Nibiru Ecosystem Update #3 - May 2025

Nibiru V2 is now feature-complete, audited, and live with its first wave of ecosystem deployments. This update further details Nibiru Lagrange Point, a roadmap for long-term scalability, and highlights progress across real-world assets, structured products, and user incentive programs designed to drive durable adoption.

Prepared by The Nibiru Team

- You can find the full list of Nibiru Ecosystem Updates here.

- Authors: Harvey Liu, Brandon Suzuki, Unique Divine, Jonathan Chang, Erick Pinos, Kevin Yang, Gabe Whitlatch.

1 | Key Takeaways / TL;DR

- Nibiru V2 ("Nibiru EVM Upgrade"): Nibiru Multi VM unifies EVM and Wasm into a single environment without requiring Layer 2 or bridge dependencies.

- Nibiru Lagrange Point:

- NibiruBFT: A modified CometBFT consensus engine, NibiruBFT touts faster block times, priority-enshrined block and mempool lanes, more robust and seamless networking, and increasingly lightweight storage and verification.

- Nibiru Adaptive Execution: This enhancement of Nibiru's execution engine will bring faster block times and increased throughput through a novel reordering concurrency design that will increase parallelizability, all while operating seamlessly with Nibiru’s Multi VM design.

- Nibiru App Ecosystem: Deployments of consumer applications and infrastructure, comprised of DEXs, bridges, launchpads, and structured products to go live in tandem. Notable mentions include LayerZero & Stargate, Syrup Finance, Element Marketplace, Sai Perps, MIMSwap, Abracadabra, and LayerBank.

- EVM Points Program: The program will reward on-chain contributions for sustained liquidity and DeFi usage, leveraging Merkl’s liquidity solutions and Galxe’s support to enhance Nibiru’s ecosystem. This will kick start the ecosystem, encourage long-term growth, and help drive liquidity on the chain and usage of apps like Sai Perps.

- Structured Products & RWAs in Focus: Nibiru centers business development efforts around structured products and real yield, building utilities on top of stNIBI, SyrupUSDC, and Sai Liquidity Provision (SLP) vaults.

Table of Contents

- Nibiru Ecosystem Update #3 - May 2025

- 1 | Key Takeaways / TL;DR

- 2 | Product Development & Ecosystem Updates

- 3 | Near-Term Execution Plans

- 4 - Lagrange Point, NibiruBFT, and the Nibiru Execution Engine

- 5 - Why Nibiru Is Betting on Yield, RWAs & Structured Products to Lead Real Adoption

- 6 | Legal Disclosure

Legal Terms for this Document

This Ecosystem Update is provided by the Nibiru team. The Nibiru project is led by the Matrix Foundation (referred to herein as "Nibiru," "we," and "us") and supported by various unrelated entities, including Nibi, Inc., and its respective personnel, as well as other entities and personnel that the Matrix Foundation has engaged for services, some of whom are mentioned in or have contributed to this update.

The information provided in this Update does not constitute investment advice, financial advice, trading advice, legal advice, or any other form of advice. The contents of this document are for general informational purposes only, are subject to change without notice, and does not constitute any form of contract or obligation on the part of Nibiru. This Update does not replace, amend, or override any applicable terms of service, agreements, or legal obligations associated with the project.

A complete Legal Disclosure is provided at the end of this document. By accessing this Update, you acknowledge that you have read, understood, and agree to be bound by the terms set forth in this section and in the full Legal Disclosure. If you do not agree to these terms, please do not access or use any information contained within this document.

2 | Product Development & Ecosystem Updates

Nibiru’s ecosystem offers compelling experiences and real value: true ownership, steady rewards, and lasting value. it blends core DeFi primitives with emerging use cases. Here’s how each component fits together: Below is an overview of how Nibiru’s apps come together to create a flywheel, combining practical DeFi with broader appeal for all kinds of users:

Website | About Nibiru | Docs / Whitepaper | X/Twitter

2.1 - Key Deployments

Bridge to Nibiru: Simplified With LayerZero & Stargate

LayerZero enables Stargate as Nibiru’s canonical bridge for assets like USDC, USDT, and WETH, ensuring secure and rapid connectivity within the ecosystem.

Oku.Trade for Advanced Trading

Oku brings Uniswap’s V3 AMM contracts to Nibiru enabling concentrated liquidity for LPs and various order types for users looking to swap.

Syrup for Sustainable High Yields

Maple’s Syrup platform provides overcollateralized lending yield >10% on USDC ensuring sustainable composable yield throughout the ecosystem

LayerBank for Borrowing

LayerBank is a lending marketplace where assets like uBTC can be used as collateral, allowing users to capital efficient without leaving the Nibiru ecosystem.

Abracadabra for Stableswap and Leveraged Yields

Abracadabra enables leveraged yield opportunities with stable subsidized borrow rates. While MIMSwap brings an advanced stableswap for pegged assets.

BIMA for Bitcoin-Backed Lending

Bima lets you use BTC as collateral to mint USBD, a stablecoin backed by BTC derivatives. USBD earns sUSBD, boosting capital efficiency through automated yield strategies.

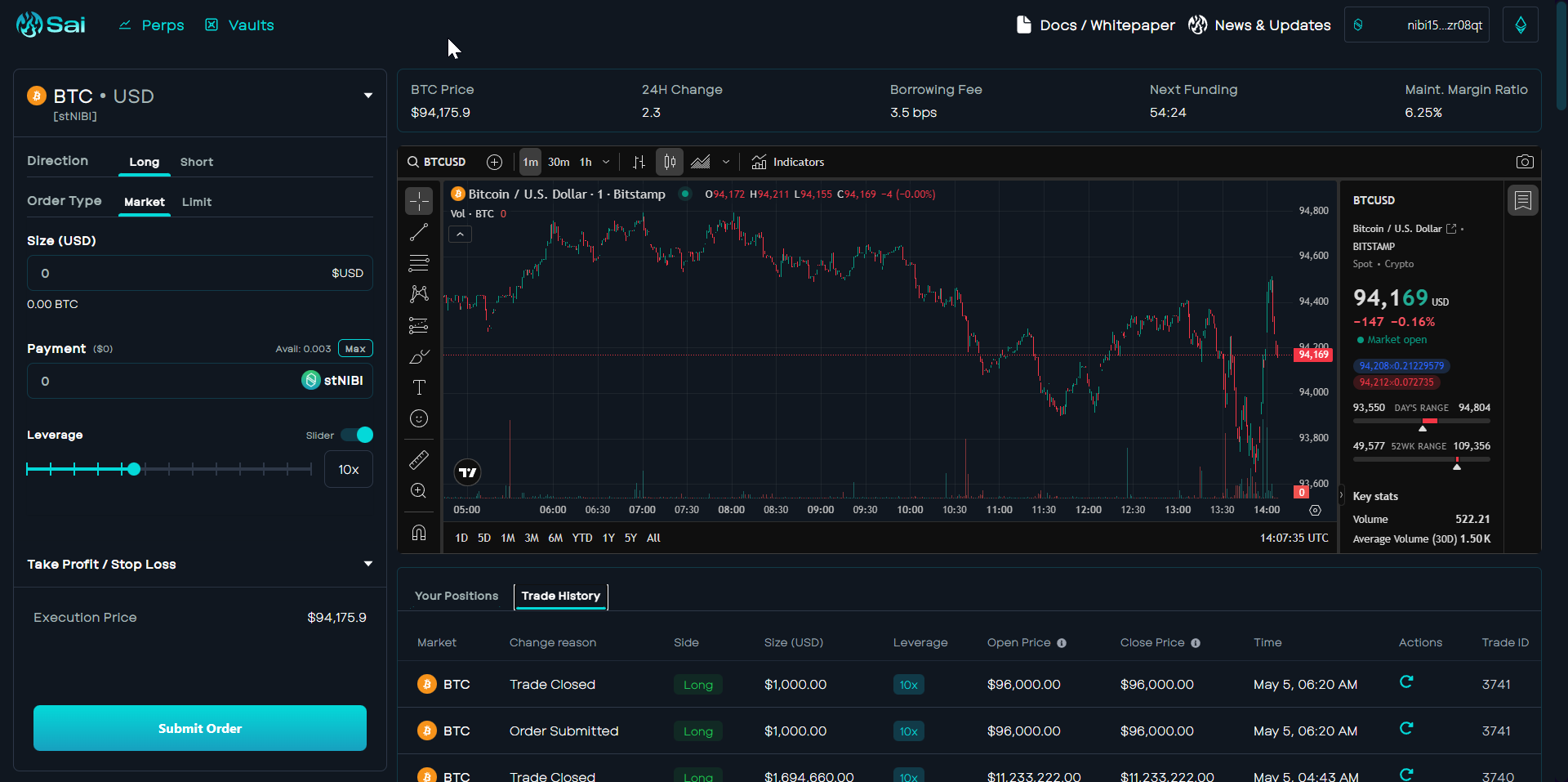

Sai Perps Exchange

A decentralized futures platform offering leveraged trading with fast finality and deep liquidity, all while letting users maintain full custody of their funds.

Element NFT Marketplace

The flagship NFT marketplace on Nibiru, Element aggregates listings, simplifies bulk transactions, and enables creators to mint and launch collections easily.

2.2 - Network Upgrades on Mainnet

v2.2.0 - Mar 27, 2025:

- During this time, we published and iterated on the @nibiruchain/solidity and @nibiruchain/evm-core packages. The @nibiruchain/solidity package includes Nibiru EVM contracts, ABIs for Nibiru-specific precompiles, and interfaces for core protocol functionality. And the @nibiruchain/evm-core package is a TypeScript library for use in building applications that leverage functionality custom to the Nibiru EVM.

- The NIBI token, stNIBI token (liquid staked NIBI), and Astrovault’s AXV now have canonical ERC20 representations on Nibiru and can be managed with EVM wallets like MetaMask, Phantom, and Coinbase Wallet.

- This upgrade included enhancements for EVM transaction indexing. We improved log encoding on the EVM, the marshaling of logs, and stabilized service shutdown procedures. These changes collectively result in more reliable transaction tracking.

v2.1.0 - Feb 25, 2025:

- The most significant changes from the v2.1.0 mainnet upgrade were the addition of the ICS-08-wasm IBC client and update of Wasm VM to v1.5.8.

- Traditionally, IBC light clients in Cosmos SDK chains were hardcoded in Go, requiring an on-chain governance vote and coordinated upgrade (hard fork) to add new client types or upgrade existing ones.

- This upgrade introduces a Wasm VM that can host light client bytecode compiled from any language (Rust, C/C++, Go, etc.), standardizing the interface to ICS-02 and acting as a proxy light client

- This is important because it makes it possible to add new IBC light clients to Nibiru without a coordinated upgrade by validators. The process also becomes less error prone because developers on Nibiru won’t need to worry about as many intricacies of different consensus algorithms, change the blockchain codebase to add new light clients, or go through a multi-stage code release.

2.3 - App Ecosystem: New Deployments

| Project | Description | Status |

|---|---|---|

| Algebra | DEX Engine | Licensed to use their service integrations and tooling on Nibiru |

| Band | Cross-chain data oracle platform with real world data and APIs | Launched on Mainnet |

| Gelato | Enterprise-grade rollup infrastructure | Deployed on Mainnet |

| Element | NFT Marketplace | Live on Mainnet |

| Friendly | Lending Platform | Live on Testnet |

| Hyperlane | Permissionless interoperability protocol | In Development |

| Gamma | In Development | |

| Merkl | Protocol and platform for streaming incentives onchain | In Development |

| ProtoFire | Smart-contract based multisig wallet. SAFE deployment. | Launched on Mainnet |

| Stargate | Fully composable liquidity transport protocol / bridge | Launching USDC, USDT, wETH on Mainnet. |

| Supra | Extreme throughput, native oracle services. | Launched on Mainnet |

| Unstoppable Domains | Decentralized domain names | Live on Mainnet. 300+ domains minted |

| B² Network (uBTC) | Bitcoin with proof-of-stake rewards from B² Network, an EVM compatible, Bitcoin Layer 2 Network | Will be supported via Hyperlane |

2.4 - App Ecosystem: Existing App Highlights

| Project | Description | Status |

|---|---|---|

| Abracadabra | Lending/Leveraged Yield Farming Product Suite | Passed Abracadabra Improvement Proposal (AIP-62) |

| Astrovault | Cross-Chain Value Capture Spot DEX | Launched on Mainnet, $116k in liquidity |

| Aviatrix | Aviation-Themed Crash Game | NIBI supported for wagering |

| Balanced Network | Cross-Chain Swaps and RWA Backed Stablecoin Platform | Working on Mainnet Beta |

| Bima | Liquid Staking Bitcoin | Working on Mainnet Beta |

| BRKT | Binary & Bracket-Style Prediction Market | Live on Mainnet, Markets TBD |

| DTrinity | Subsidized Borrowing and Stablecoin | In Development |

| Eris Protocol (stNIBI) | Liquid Staking Platform and Slow Burn Arbitrage Protocol. | Live on Mainnet, $800k in TVL |

| Euclid Protocol | Unified Liquidity Layer using Virtual Routing and Forwarding (VRF) | Live on Testnet |

| Every Finance | Managed funds, volatility targeting products and index funds | In Development |

| Galaxy Exchange / Swing | Cross-Chain Bridging & Swap Protocol | Live on Mainnet Bridging NIBI earns points as part of Swing Points Program. |

| Gemach AI | DeFAI agent | Live on Mainnet. Supports several dapps and swapping. |

| Gemach Lend | Lending Platform | In Development |

| GBot | Telegram wallet/sniper bot | In Development |

| HiYield | Tokenized Treasury Bills | Live on Testnet |

| Ichi | Automated Liquidity Strategies for DeFi Yield | Partnership Signed. In Development |

| LayerBank | EVM-based Cross-Chain Lending Platform | In Development |

| LayerZero | Omnichain Interoperability Protocol | Launched on Mainnet |

| MIMSwap | Stableswap AMM in the Abracadabra Ecosystem | Proposal (AIP-62) Passed. In Development |

| Nebula | Lending Platform | Live on Testnet |

| Oku Trade | DEX Aggregator / Uniswap V3 Deployer | Live on Testnet with native Uniswap V3 contracts. Mainnet Ready. |

| OmniPump | Launchpad for Fair Launches and Memecoins | Launched on Mainnet |

| OmniSwap | AMM DEX | Launched on Mainnet |

| OpenEden | Tokenized T-Bills | Will be available via LayerZero |

| OpenMark | NFT Marketplace | Launched on Mainnet |

| PRDT | Fast Paced Prediction Market | Live on Testnet |

| Routescan Explorer | EVM Explorer built by the team powering the Explorers for Avalanche and Optimism | Launched EVM Testnet Explorer and EVM Mainnet Explorer |

| Sai | Competitive perpetual futures DEX enabling the creation of markets on any asset | Contracts on testnet. App development soon to reach mainnet in early Q2. |

| SilverSwap | Uniswap V4-based Spot DEX | Deployed contracts on mainnet. Soon to launch app. |

| Swify | Concentrated Liquidity Spot DEX | Live on Testnet. Mainnet Ready |

| Syrup | Tokenized Private Credit | Will be available via LayerZero |

| TanX | Non-Custodial Orderbook Spot DEX | In Development |

| Virtual Labs (VDEX) | Perps Platform | In Development |

| Via Labs | Bridged USDC | Launched on Mainnet |

3 | Near-Term Execution Plans

- Deploy key dApps on mainnet followed by incentive campaigns to bootstrap liquidity into Nibiru’s DeFi ecosystem.

- Continue partnerships with priority dApps in the ecosystem to encourage and continue developing novel structured products.

- Actively onboard new communities to build and collaborate on Nibiru, focusing on verticals like DeFi, structured products and real-world assets (RWAs), DePIN/AI, and NFT ecosystems.

- Improve Sai’s user experience starting with advanced order types, institutional functionality and additional forms of collateral that will connect with the ecosystem.

3.1 - Sai Perps Nears Launch on Nibiru

Sai is finalizing core features to bring perpetual futures trading and advanced liquidity vaults to the Nibiru blockchain. Key highlights include:

- Wasm Contract Refinements: Sai’s development team has tightened integration between its Wasm-based smart contracts and Nibiru’s consensus layer, improving security and efficiency over traditional EVM options.

- Oracle Enhancements: Both native and custom oracle feeds have been fine-tuned for most accurate margin checks and PNL calculations, reducing forced liquidations and avoiding index price discrepancies.

- Adaptive Borrowing Fee Upgrades: A borrowing mechanism that dynamically responds to open interest imbalances, protecting liquidity providers.

- Code Audits & Testing: Multiple internal audits and testnet evaluations have strengthened contract reliability. The team has also stress-tested liquidity vault epochs to limit withdrawal shocks during high volatility.

- Product Expansion: Sai will soon feature tokenized real estate in partnership with Coded Estate. Sai will also include additional asset classes such as commodities and indexes.

3.2 - Onchain Usage Campaigns | Nibiru EVM Points Program (Update)

Nibiru has integrated with Merkl to track TVL focused missions on complex DeFi focused dApps while Galxe will similarly support Nibiru applications leveraging their large network of users and social based tasks. The points program is designed to reward users who commit liquidity for longer durations, and the team is actively onboarding new protocols with incentives such as multipliers for those that contribute meaningful TVL and revenue that is particularly valuable to the ecosystem's long-term health.

4 - Lagrange Point, NibiruBFT, and the Nibiru Execution Engine

In the last Nibiru Ecosystem Update, we introduced a forward-thinking suite of upgrades to tackle blockchain’s hardest challenges: unified EVM–Wasm assets (FunToken), advanced transaction execution with multiple facets of parallelization, MEV minimization (Block Lanes), validator scaling, and even post-quantum cryptography. Since then, Nibiru has evolved and fleshed out those concepts into a coherent, production-focused package.

4.1 - NibiruBFT - Validator Clusters, BLS Signatures, Multi-Lane Blocks, &

QUIC

4.1.1 Validator Clustering

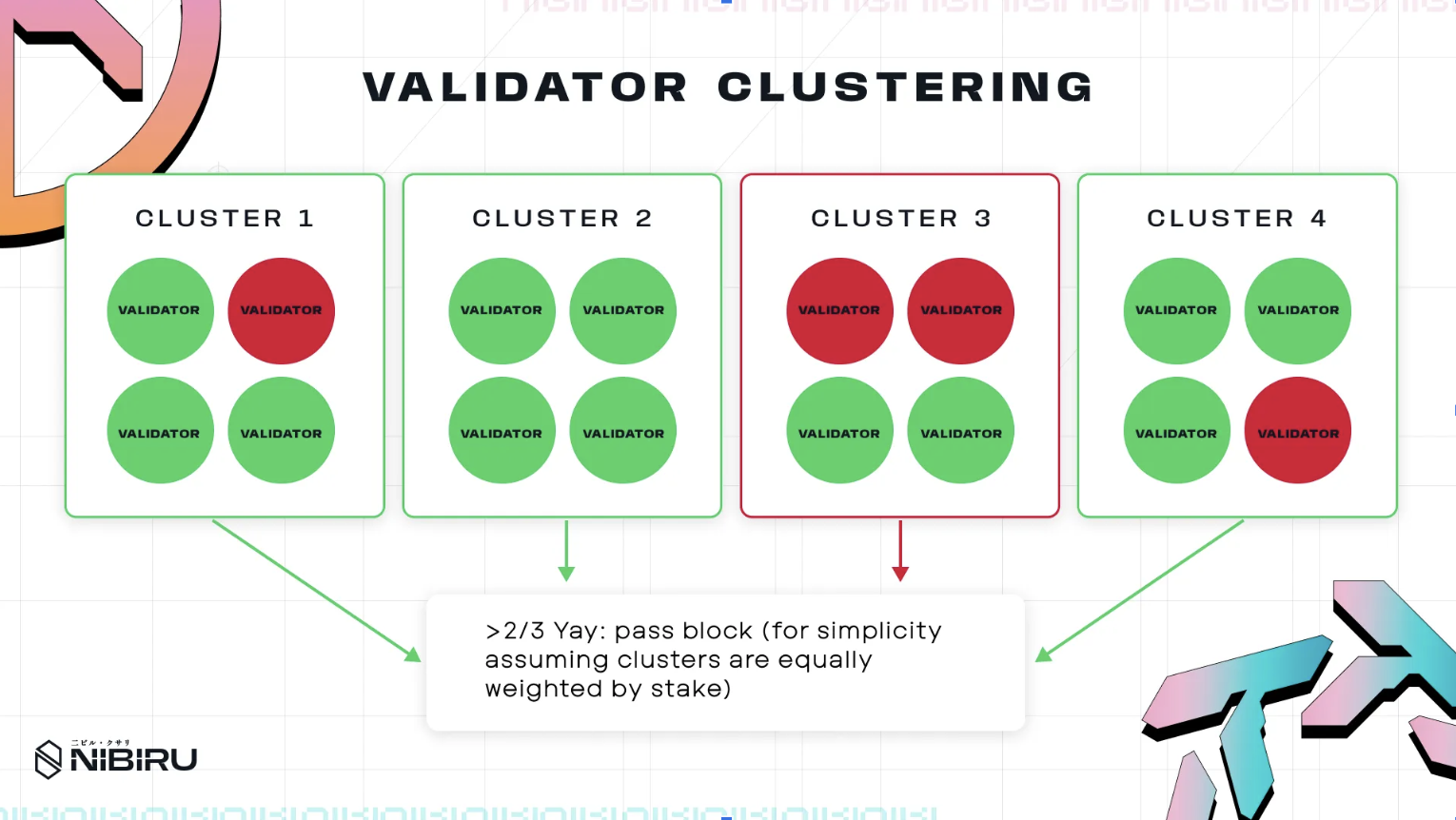

Previously, the “validator groupings” concept aimed to fix CometBFT’s n² messaging overhead. Now, under NibiruBFT consensus:

- Clusters: Validators are dynamically shuffled into clusters each epoch for an intra-cluster consensus to achieve a precommit state.

- Intra-Cluster → Inter-Cluster: Each cluster only needs one representative in the final commit, drastically cutting message complexity from O(n²) down to roughly (n/k)², given n>>k.

Beyond simple grouping, secondary Geo-Clustering further optimizes intra-cluster latency by grouping nodes with lower RTT (round-trip times). This ensures block finality remains fast, even as the validator set grows significantly.

We also propose that a dynamically epoch-assigned cluster that does not respect stake weights be implemented to contain consistently underperforming validators to further reduce the lower bound on consensus.

4.1.2 BLS Signature Aggregation

We teased BLS before for lighter block headers and faster verifications:

- Two-Stage Aggregation: Within each cluster, signatures on the proposed block are aggregated into one BLS signature. Representatives then aggregate again at the top level.

- Size & Speed: A single aggregated signature scales far better than one ECDSA signature per validator, enabling networks with hundreds of validators without bloated headers or inefficient verification.

- Faster verification results in faster block times and reduced header size allows for increased block space allocated for transactions.

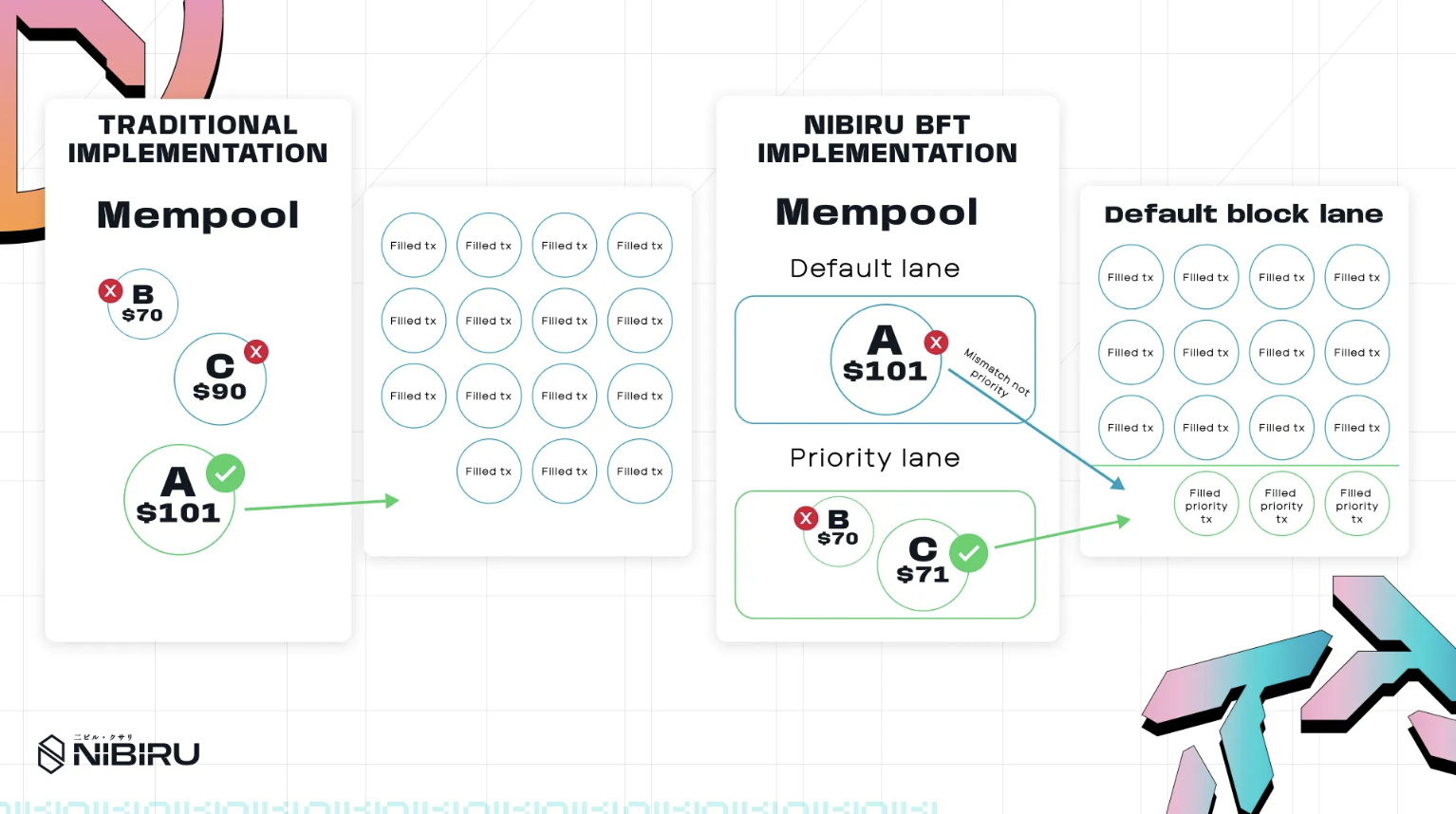

4.1.3 Multi-Lane Mempool and Block Structure

We propose the segregation of lanes within both mempools and within blocks:

- Multiple Transaction Lanes: Priority lane(s) dedicated to critical transactions (e.g. oracles, liquidations) while a default, non-prioritized lane exists for regular transactions.

- MEV Containment: MEV transactions are specified in the MEV lane, containing MEV behavior solely to this lane.

- Lane-Based Gas Auctions: Each lane has its own “gas market,” preventing bidders from blocking crucial transactions through gas wars (e.g. MEV behavior cannot outcompete oracle updates due to dedicated block and mempool space reserved for high priority transactions)

4.1.4 QUIC Networking for Faster Consensus

Traditional TCP-based networking can suffer from latency spikes and cumbersome handshakes (connection establishment). QUIC integration in NibiruBFT networking facilitates:

- Faster Connection Setup: Fewer round-trips, so validators synchronize quickly.

- Stream Multiplexing: Packet loss in one data stream doesn’t stall others.

- Connection Migration: Maintains session parameters even if a node’s IP address changes (reducing unnecessary handshake overhead and avoiding cumbersome parameter discovery).

All these changes align to keep networking robust and latency efficient, allowing for larger validator sets and increased throughput, while also prioritizing blockchain health and facilitating a seamless, safe environment for end users.

4.2 Nibiru Adaptive Execution: The Next Evolution of PARE

Our previous “PARE” (Pipeline-Aware Reordered Execution) concept reappears as Nibiru Adaptive Execution:

- Reordering Blocks: Transactions are partitioned into groups of transactions called “reordering blocks.”

- Real-Time Conflict Tracking: Transaction read/write sets are tracked to dynamically reorder transaction blocks, executing blocks with high predicted contention sums first.

- Parallel Execution: Non-conflicting transactions run concurrently; only true conflicts trigger rollbacks.

By proactively reordering, we minimize “harmful delays” and reduce the overhead of constant rollbacks. This is critical in high-frequency DeFi contexts with many concurrent trades.

4.3 MultiVM Architecture: Seamless EVM & Wasm (and More)

4.3.1 Unified Assets & Execution

The old Lagrange Point text touted “FunToken” to unify EVM and Wasm assets without bridging. That’s now under the broader MultiVM design:

- Native EVM: No sidechains or bridging. Ethereum tools (Metamask, Remix, Hardhat) work natively on Nibiru.

- Wasm: Rust-based contracts and robust security features (re-entrancy protection).

- Shared State: Thanks to a unified bank module, EVM- and Wasm-based tokens share the same supply - no wrapped illusions.

- Parallelization: With Adaptive Execution, non-conflicting EVM and Wasm transactions can execute in parallel.

Future expansions could embed additional VMs (Move VM, Solana VM) into the same first-class environment.

4.4 Quantum-Resistant Cryptography (QRC)

Nibiru’s earlier mention of post-quantum security has been more fleshed out, but is still being fine tuned and slated as a long term pursuit:

- ML-DSA Signatures: Replacing ECDSA with a lattice-based scheme (ML-DSA) that’s believed to be secure against current quantum attacks (e.g. resistant to Shor’s algorithm, unlike ECDSA).

- Future-Proofing: As quantum computing matures, Nibiru remains on track to preserve security, an important differentiator for enterprise-grade apps.

4.5 The Road to Nibiru V3

When “Nibiru Lagrange Point” was first introduced, a roadmap outline to unify VMs, mitigate MEV, handle concurrency, and prepare for quantum safety was created. Now, the core pieces have evolved into:

- NibiruBFT → A reimagined consensus layer with validator clustering, BLS signatures, multi-lane mempools/blocks, and QUIC.

- Adaptive Execution → Next-gen concurrency management (the new face of PARE).

- MultiVM → EVM, Wasm, and future VMs all secured by one chain.

- Quantum-Resistant Cryptography → Gradual rollout of ML-DSA (lattice-based) and enhanced hashing.

Each piece stands on its own but also complements the others - reducing overhead at the consensus layer, boosting throughput in execution, and enabling frictionless cross-VM dApp development. The result is true high performance, decentralized infrastructure, equipped to serve DeFi at scale and beyond.

5 - Why Nibiru Is Betting on Yield, RWAs & Structured Products to Lead Real Adoption

Yield-bearing stablecoins pose a challenge to profit margins of traditional issuers. Despite promises of broader on-chain market exposure, synthetic assets continue to face obstacles related to liquidity and regulation. Conversely, real-world assets (RWAs), ranging from tokenized T-bills to real estate, hold the potential to democratize access, provided compliance is effectively managed.

Meanwhile, structured products, such as Nibiru's proposed delta-neutral stNIBI vault, leveraged SyrupUSDC vault, and hedged SLP positions, are simplifying intricate DeFi mechanisms, enabling accessible and sustainable returns for users. Macroeconomic factors like inflation and fears of recession may renew interest in gold and on-chain hedges, even as the excitement experimental assets such as memecoins and AI narratives diminishes.

Institutional players are increasing their involvement with stronger risk management frameworks, suggesting that while retail enthusiasm cools, broader adoption is developing under more measured, long-term strategies.

Real-World Assets have Shown Tangible Progress

Tokenized T-bills and credit lines introduced investors to real yields secured by off-chain collateral. Now, builders are expanding into real estate, venture funds, and private equities. While these products will require KYC for regulatory compliance, they hint at a future where exclusive asset classes become accessible to retail clients.

Structured Products

Structured products have continued to emerge as relevant in the next iteration of DeFi, but for sustainable yield. Early adopters increasingly prefer automated vaults that take care of strategy selection, leverage, and risk management. These solutions simplify complex DeFi mechanics like leveraged staking, exotic options overlays, and multi-layer lending into user-friendly products.

Within structured products, Nibiru is exploring several example vaults such as:

- Delta-neutral stNIBI Vault: A vault like this might liquid stake NIBI, then short NIBI on Sai, earning ~30% APY while minimizing directional risk. This could provide compelling and sustainable returns.

- Leveraged SyrupUSDC Vault: Deposit USDC, loop it via Syrup on platforms like Abracadabra. With controlled leverage, yields can exceed 40%, assuming disciplined risk thresholds.

- Hedged SLP Position: Provide LP on ETH/BTC/SOL, short the same assets on Sai. Capture trading fees while neutralizing price swings.

Each of these strategies compresses layered DeFi mechanics into single-token entries that aren’t purely speculative. Less noise and more signal.

6 | Legal Disclosure

No Offer or Solicitation

This Update does not constitute an offer to sell or a solicitation of an offer to buy any securities, tokens, or any other form of investment in any jurisdiction. The distribution or dissemination of this document may be restricted by law in certain jurisdictions, and it is the responsibility of any person in possession of this Update to comply with any such laws and regulations.

No Rights to Token-holders

Purchase of NIBI tokens or any other digital assets mentioned herein (each and collectively the "Tokens") does not represent or confer any ownership right or stake, share, security, or equivalent rights, or any right to receive future revenue shares, dividends, intellectual property rights or any other form of participation in or relating to Nibiru, any of its affiliates, Nibiru and its related products, and/or services or any part thereof. The reader acknowledges and accepts that at no time and under no circumstances shall they be entitled, as a holder of any Tokens, to vote, receive dividends or be deemed the holder of equity or capital stock of any entity for any purpose, nor will anything contained herein be construed to confer on the reader such rights.

Forward-Looking Statements

Certain statements contained in this Update may be forward-looking, including but not limited to plans, goals, and expectations regarding the future business, operations, and performance of the project. These statements are based on current beliefs, assumptions, and projections and are subject to risks, uncertainties, and changes beyond the control of the project. Actual results may differ materially from those expressed or implied in any forward-looking statements.

Regulatory Status

The regulatory status of the Tokens and blockchain technology, digital assets, and cryptocurrencies generally is uncertain and evolving. This Update and the project described within may be impacted by legal, regulatory, and compliance requirements. It is the responsibility of potential participants to determine whether they can legally acquire, hold, or participate in Nibiru’s activities under the laws of their jurisdiction.

No Liability

Nibiru, its affiliates, contractors, and their respective officers, employees, and agents shall not be held liable for any loss, damage, or liability arising out of or in connection with the use of this Update, the project, or any associated products or services. Participation in the project and any related activities is done at your own risk.

No Guarantees

There is no guarantee or assurance that the project, its platform, or the Tokens described in this Update will achieve any of its goals, intended outcomes, or objectives. The value and functionality of any Tokens are not guaranteed, and they may be subject to significant volatility, market forces, and other risks. Token holders should not expect to have the ability to influence the management or decision-making of Nibiru.

Risk Factors

Participation in the project and the use of tokens involve significant risks, including but not limited to financial, regulatory, technological, and market risks. It is strongly recommended that participants fully understand these risks before engaging with the project or acquiring any tokens.

Independent Advice

Readers of this Update should seek independent professional advice regarding their individual circumstances before engaging in any activity related to the project.

Amendments and Updates

Nibiru reserves the right to amend, modify, or update this Update or any of the information herein at any time without prior notice. It is the responsibility of readers to stay informed of any changes.