NAN 002: Liquidity Surges, New Omnichain Fungible Tokens, and Sai's Path to Mainnet

Posted by Unique on 2025-09-28

A few months ago, Nibiru’s onchain activity was measured in its earliest millions. Today, liquidity is multiplying, yield assets are arriving, and the first native trading app is nearing launch. NAN 002 picks up where the story left off. Liquidity is scaling, new omnichain assets are live, and Sai is approaching mainnet readiness. Each piece strengthens the others, and together help create a more usable and resilient Nibiru.

Nibiru Liquidity on the Rise

Nibiru’s tracked liquidity has grown sharply since NAN 001, rising from about $1 million to over $5 million. More than half of that growth came from over $2.5 million in stablecoin inflows now circulating onchain.

A large share of the deposits have gone into automated liquidity management projects like Ichi, Gamma Strategies, and Steer Protocol. These teams provide easy-to-use vaults that handle the complexities of concentrated liquidity on Uniswap V3, making it possible for more participants to earn from passive LPing without needing to manage positions by hand. Most of this activity has been visible through pools on Oku, Nibiru’s Uniswap V3 deployment.

Just as Block Party Season 1 brought several live apps, Season 2 is already bringing deeper liquidity, new launches, and Sai, the first trading app built by the Nibiru team. Although liquidity in the form of TVL is only one measure of progress, the steady inflows signal that app builders and partners are committing meaningful capital to the ecosystem. This marks a clear milestone in the chain’s evolution.

Opening New Yield Doors: Omnichain Fungible Tokens (OFTs) on Nibiru

The primary cross-chain messaging infrastructure on the Nibiru EVM is LayerZero. To open up ease of bridging and access to liquidity, the team worked to set up and launch omnichain fungible tokens (OFTs) for key assets from other EVM chains. Standard assets like USDC, WETH, and WNIBI, and also yield-bearing assets like ynETHx, uBTC, sUSDa, and stNIBI.

Each of these OFTs has dedicated pages on the Nibiru website that highlight whether to obtain these assets, how to bridge them, and what their onchain contract addresses are on chains like Base, Ethereum, and Nibiru.

These OFTs matter because they lower the barrier for users to onboard with familiar assets while also widening Nibiru’s surface of passive yield opportunities. Yield-bearing tokens in particular can compose with vaults, perps, and other DeFi elements on the chain, giving builders more primitives to work with.

Current highlights include:

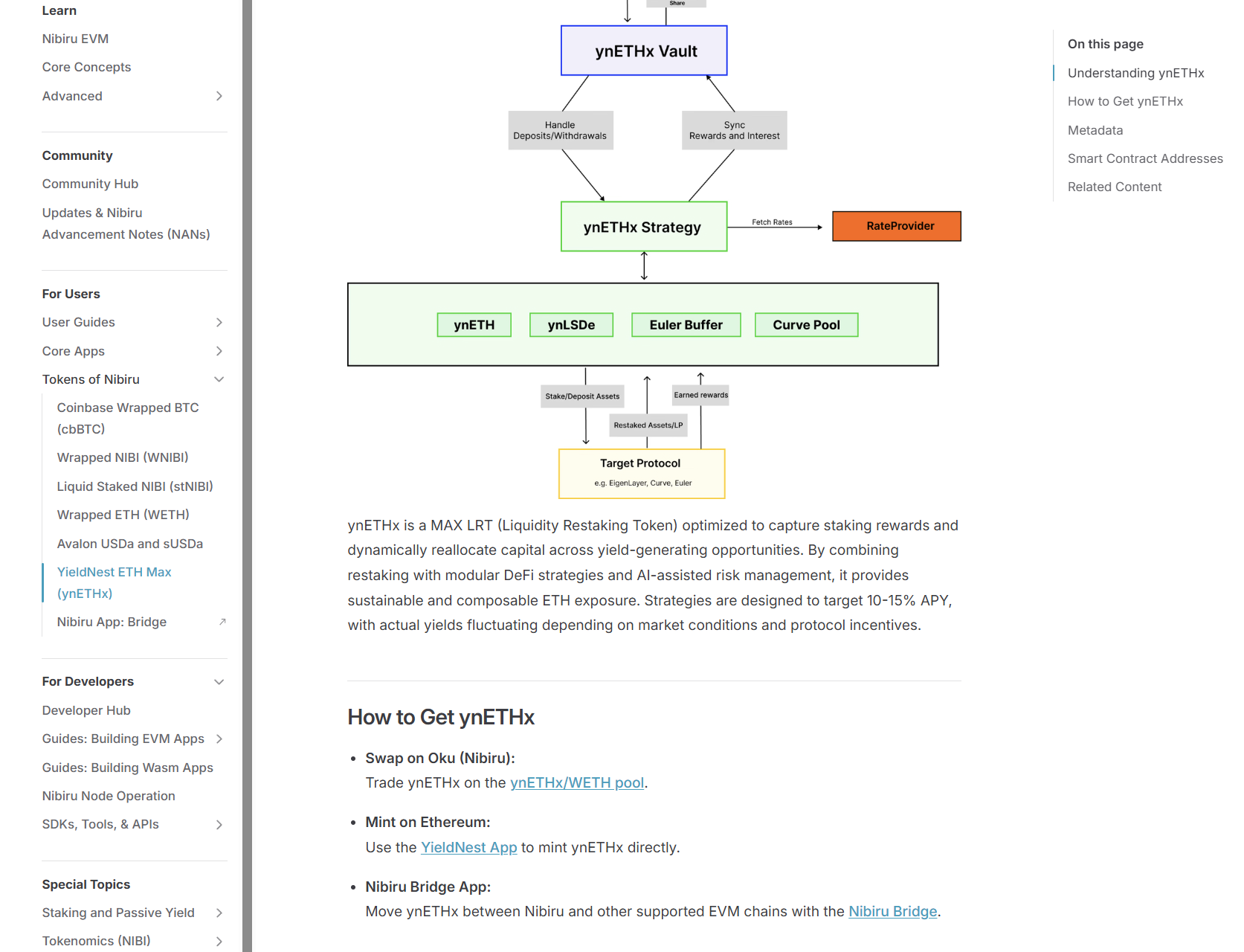

- Yield Nest ETH Max (ynETHx): YieldNest ETH MAX (ynETHx) is a LayerZero OFT token representing YieldNest's ETH-based strategies. Designed to maximize returns on ETH and LSD assets.

- Liquid Staked NIBI (stNIBI): Liquid Staked NIBI (stNIBI) is the liquid staked variant of the Nibiru token (NIBI). It allows users to earn staking rewards automatically while retaining liquidity, enabling stNIBI to be traded or used across Nibiru applications instead of being locked up.

- Wrapped NIBI (WNIBI): ERC-20 version of NIBI. Analogous to WETH.

- Coinbase Wrapped BTC (cbBTC): A wrapped Bitcoin ERC-20 token issued by Coinbase on the Ethereum blockchain.

- Avalon Labs USDa and sUSDa

- USDa is Avalon Labs' omnichain stablecoin, minted via the CeDeFi (Centralized decentralized finance) CDP (collateralized debt position) system. It can be created by depositing collateral (currently FBTC, with more assets to come) or by converting USDT 1:1. One of USDa's unique features is the guarantee of conversion back to USDT at a 1:1 ratio through the Avalon vault on Ethereum.

- sUSDa is the yield-bearing version of USDa. Users can deposit USDa into the Avalon Savings Account to receive sUSDa, which accrues yield sourced from USDa borrowing rates and revenues from Avalon's lending platform. Yields have the potential to reach sustainable double-digit APRs, incentivized to maintain a staking ratio under 50%.

B Squared Network has also integrated uBTC, a token offering native BTC yields. Hyperlane is the bridge used to bring uBTC to Nibiru, and there are pools to access uBTC live on Oku. We'll soon have a page with detailed information on uBTC as well.

Sai Perps Updates

End-to-End Testing Across Wasm and EVM

Sai continues to progress toward mainnet launch. One of the major steps forward has been the addition of a new suite of end-to-end tests. These spin up a fresh Nibiru blockchain from scratch, deploy all of Sai’s Wasm contracts, and then run through market creation and trades across multiple order types. Because Sai is a multi-VM app built in Wasm with full EVM support via Nibiru’s precompiles, the tests cover both Wasm-only flows and EVM trading paths. This ensures the full stack behaves as intended before new code makes its way upstream.

Fixing Gas Estimation for Reliable Trade Execution

We were working through issues with selecting accurate gas values when broadcasting trades. In practice, the app’s suggested gas limits for opening and closing positions were often too low, leading to unnecessary “out of gas” failures. That bug has now been fixed. Gas is dynamically estimated with a buffer, giving traders a smoother experience with fewer failed transactions and a more mature feel overall.

Frontend Improvements: Loading States and Faster Queries

On the frontend, we added loading states for app startup and when switching markets, so users see clearer feedback when new data is streaming in. At the same time, async state management was cleaned up to cut down on redundant queries and improve responsiveness.

Backend Enhancements: Accurate SLP Vault Revenue and APY

On the backend, the indexer was extended to track total revenue across SLP vaults and to generate more accurate profit and APY calculations. This makes vault performance data more reliable and reduces discrepancies that previously came from approximations.

Upgradeable EVM Interface for Smooth Contract Updates

Next up is further testing of Sai using an upgradeable EVM interface. The system will adopt a transparent proxy pattern so smart contract upgrades can happen cleanly without requiring manual changes in the frontend. This is a near-term milestone on the path to mainnet release.

Closing Thoughts

Liquidity is deepening, yield assets are finding their place onchain, and Sai is moving closer to mainnet. Each of these threads strengthens the others: OFTs expand the surface for passive yield, liquidity vaults make participation easier, and Sai will showcase what's possible when trading, yield, and infrastructure come together.

Season 2 is about proving that Nibiru can support not just launches, but sustained usage and growth. Sai, as the first trading app built by the Nibiru team, is expected to play a leading role here while remaining part of a broader ecosystem puzzle.

The purpose of NANs is to document this momentum clearly and consistently. If you have feedback or questions, reach out on Telegram, Discord, or directly. These notes are meant to spark dialogue as much as they are to capture decisions.